Some Ideas on Accounting Okc You Need To Know

With so many accounting companies out there, how do you pick the best one? Here are four vital steps to take when selecting an accounting company: 1. Think about the fees charged by the accounting company. You don't want to overpay for accounting services, however you likewise don't want to choose a company that is so low-priced that they cut corners on quality.

The Only Guide for Real Estate Bookkeeping Okc

Make sure the accounting company has experience in your market. Ask the firm about their with companies in your market and see if they have any customized understanding or accreditations that would be helpful to you.

Inquire about the firm's philosophy on taxes. You need to have a basic idea of how you wish to approach taxes, and you'll desire to make sure that your accounting company is on the exact same page. Inquire about their thoughts on so that you can be sure they're lined up with your own views.

Check out the company's references. Much like you would with any other organization choice, you'll desire to ensure you're selecting a trustworthy and qualified company. Ask the company for recommendations from previous clients and provide a call to discover out how satisfied they were with the services they got.

How Real Estate Bookkeeping Okc can Save You Time, Stress, and Money.

By following these four actions, you can be positive that you're picking a qualified and that will help your service succeed. Think about the fees charged by the accounting firm - Important Actions in Choosing the Right Accounting Company When you're searching for an accounting company, you wish to discover one that is an excellent suitable for your organization

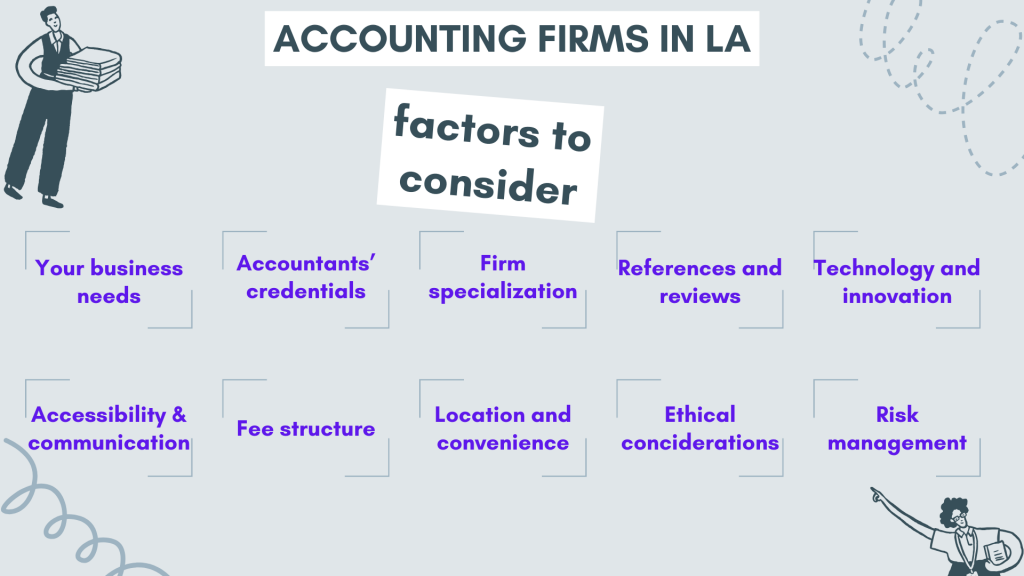

Here are some critical steps to take in selecting the ideal accounting firm: 1. Define your requirements. Before you begin consulting with representatives from potential firms, take some time to consider what your business needs from an. What services do you require? What kind of guidance are you searching for? What's your budget plan? When you have a mutual understanding of your requirements, you can begin trying to find companies that concentrate on those locations.

The Ultimate Guide To Real Estate Bookkeeping Okc

Do your research. As soon as you have a list of prospective firms, its time to do your research study. Take a look at their sites and read any online reviews or testimonials you can discover. This will give you a good sense of their track record and whether or notthey are a good fit for your organization.

Meet with agents from potential companies. When you have actually narrowed down your list, its time to begin satisfying with agents from the firms you're thinking about.

How Accounting Okc can Save You Time, Stress, and Money.

Make your choice. Choose the firm that you feel most comfy with and that you believe will best.

Consult with representatives from potential firms - Vital Actions in Picking the Right Accounting Company It is necessary to get referrals from each potential accounting company. This will assist you get a feel for the company's level of experience Find Out More and client service. Make certain to ask each recommendation the exact same set of concerns so you can compare their actions.

Bookkeeping Okc Can Be Fun For Everyone

There are numerous this decision, and it is important to select a company that will be an excellent needs.

Ensure to choose a company that uses the services that you require, such as accounting, tax preparation, and monetary planning. 2. Experience Another important aspect to think about when picking an accounting firm is their experience. Select a company that has experience working with companies in your industry. This will guarantee that they comprehend your distinct needs and can provide the finest possible service.

Okc Tax Credits Can Be Fun For Anyone

Place The place of the accounting firm is likewise a crucial factor to consider. Costs When picking an accounting company, it is likewise essential to consider their charges.

Make your choice and pick an accounting company - Crucial Steps in Choosing the Right Accounting Company.

:max_bytes(150000):strip_icc()/GettyImages-170652634-56e814b15f9b5854a9f977a5.jpg)